I'm completed reading about Candlestick short term pattern (from RECOGNIA) and GAP play. It is interesting part to formulate when to make decision to E-nter and deciding when the right time to P-rofit (to sell).

The study of the gap play have been conducted more than 100 years by the Japanese. "Gaps have always played an important part in technical analysis. The movement away from the previous trading range signifies an extraordinary shift in investor sentimen. This shift can be more in the same direction as well as a complete reversal of the existing trend. Most important is that a gap has many ramifications - Stephen Bigalow".

Gap play need u to hold long rather than intraday traders or short term traders. But the benefit of gap play are u save money on commission and give u extra advantage when combine with candlestick short pattern.

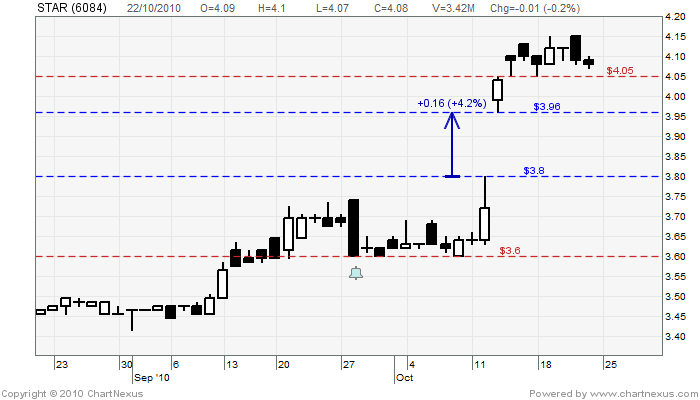

STAR

I think there is potential profit form STAR later. On 13rd Oct 2010, STAR gap up +16 sen and closed at 4.04. What i'm looking now is if the price break support at 4.04 and if broken, the next support is 3.96. I will see if the price will fill the gap or not. If rebound at 3.96, then it is the best time to enter.

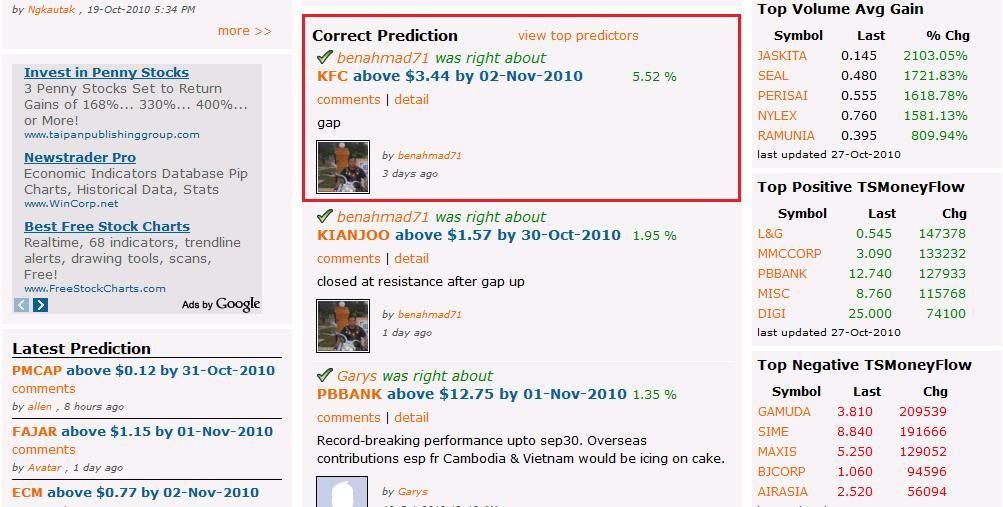

KFC

Just rebound from gap support at 3.19 and formed doji. The next day, gap up and another shooting star forming. It is normal after gap up, crowd doing profit taking and candlestick turning black or shooting star, but the bullish sentiment can be seen through the gap up. Monday, KFC should going up. So, the target price at 3.36 & 3.46.

I also pay attention to LIONFOB, AXIATA, HARTA. Pls check yourself.

No comments:

Post a Comment