It is weird that 95,000 people lost job in Sept 2010 in US but Dow up 57.90 and closing above 11000 point, the highest point since last 5 months. For me, as long as Dow closing green, i feel good. I still hold my KFC and AZRB last friday and Dow gives more confidence for this monday. Anyway, i have figure out a few good counters for all of u to trade, but please keep your stop loss in handy. If u look back for last few months, 1 day Dow up, another day down. There is still uncertainty in the market, so better be aware and trade carefully. My good friend, Austin Goh (Chart Nexus forum nick name mycpucafe), who u can see his name now in position no.3 in ECM Stockquest Competition, have the good trading strategies to make profit in the market. I observed him doing day trading, buy and sell in morning and evening, and managed to fork out at least 2-3k everyday. I think he do the same in the real live. He have practice a good discipline in trading, no emotion involve, buy low sell high, and...... no.2 and no.1 champion, your position will be replace soon.

This evening, my also good friend, CH Wong from Penang call me and give info about TWSCORP. I have look the chart and agree this is potential counter to look for. So, here..

TWSCORP

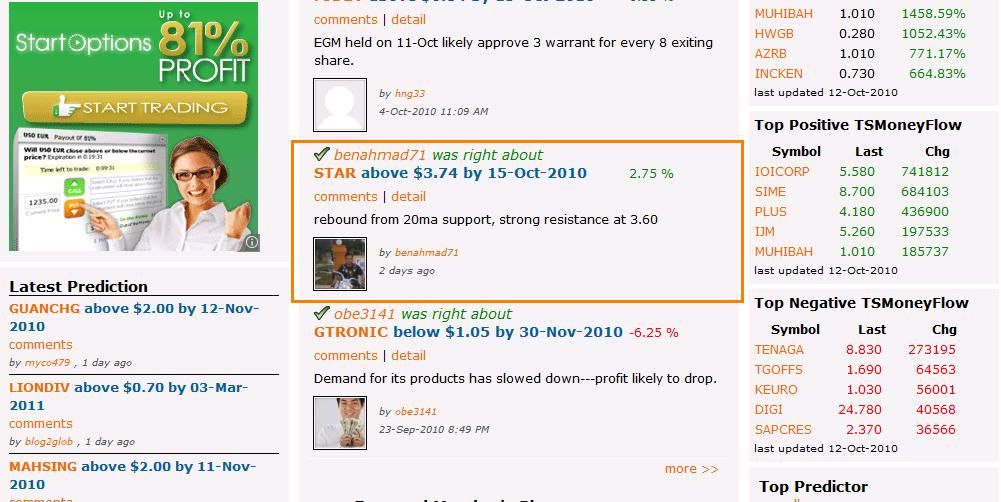

STAR

I draw the line at 3.60, this is the resistance line turn support. If u look back for the last 10 years STAR chart, u will find that there have been 5 resistances at 3.60, the last one break 3.60 and then whenever price drop to support line at 3.60, somebody will push it to rebound. So i think that, this is a safe bet and please do study on this counter. And of course u can put stop loss at 3.59.

BINAPURI (BPURI)

BPURI in construction sector. I saw potential bollinger breakout in the making, 2 white candlestick, MACD histogram green (4 red 1 green), MACD line above zero, acc/dist on the move, stochastic still low, ADI good, momentum surge, volume above 50ma vol, rsi pointed upward. The one that worry me PER (price earning ratio) at 21x. We normally only interested at counter with PER 15x and below. But if u compare to MRCB at per 82x, this is still low. Up to u to make decision. Don forget your stop loss. First cut loss is minimal, the second cut loss price will be huge. U will become the long time investor if u are not discipline.

AZRB

I'm buying AZRB last friday, by looking at the resistance, i presume my selling would be at resistance ie 1.13. So, if any of u buying AZRB last friday, good luck. TQ

'TRADING IS NOT GAMBLING, PLAY SAFE, PUT STOP LOSS'

No comments:

Post a Comment