I'm waiting to buy AIRASIA or KENCANA on tuesday morning, but both not moving as expected. At 11.00 am, I buy LHH after all the indicators look good and that morning LHH going up +8 sen. So i queue at 1.70 for 6 lots and tomorrow after 5 pm, i will know the answer whether LHH will going up or down.

KLCI need retracement for the next push breaking the new historical high, looking at black hammer at 20ma support, maybe consolidation period have ended and i still waiting tonite DJIA hold at 11,000 pts.

So, next counter i'm keen to explore are:

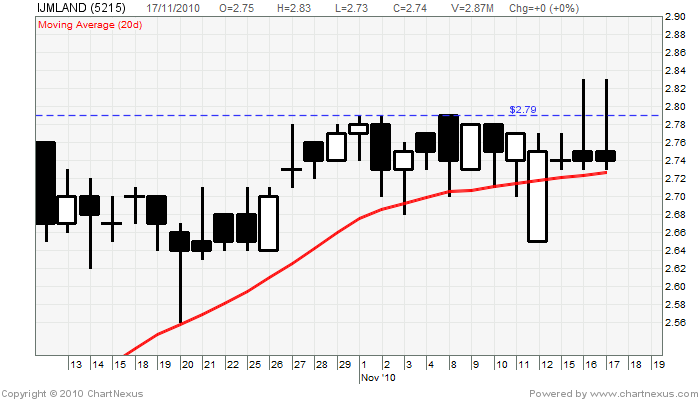

IJMLAND

Malaysian Finance elaborate more on IJMLAND + MRCB merger. U can read the news by clicking Malaysian Finance at right side of my blog. I will buy when IJMLAND break resistance at 2.79.

MEDIA

The Edge Malaysia

Media Prima posted earnings of RM71.87 million for the third quarter ended Sept 30, 2010 compared with net profit of RM17.26 million a year ago. Its revenue was RM416.75 million compared with RM206.35 million a year ago. It declared a dividend of four sen a share.

For the nine-months period, net revenue exceed the RM1 billion mark for the first time and profit after tax and minority interest from continuing operations grew from RM39 million in 3Q FY2009 to RM154 million for the same period in 2010, with strong contributions from all media platforms. Its EBITDA margin, which grew from 20% to 24% due to the increase in revenue and effective cost control measures.

“Excluding the negative goodwill arising from the acquisition of The New Straits Times Berhad (NSTP), and other exceptional items, net revenue grew by 23.3% while PATAMI from continuing operations recorded an increase from RM28.6 million for the third quarter of 2009 to RM63.1 million for the same period in 2010,” it said.

FABER

The Edge Malaysia

Maintain buy at RM2.87 with target price of RM4: We are not entirely concerned about the expiry of the original deadline for renewal of Faber’s hospital support services (HSS) concession, given that Pharmaniaga experienced the same thing with regard to the renewal of its pharmaceutical supply concession, which was eventually renewed.

While there is speculation that the government might not renew Faber’s concession for East Malaysia and politics might possibly take priority, we strongly believe that the renewal should be based on track record and performance if the government is truly committed to its transformation plan.

All said, we maintain our “buy” recommendation on Faber at an unchanged target price (TP) of RM4 as the current uncertainty might present a buying opportunity for investors who are still hopeful of a favourable outcome.

TGOFFS

RSI kiss of live, near to support - cut loss will be minimal, reward higher than risk.

No comments:

Post a Comment