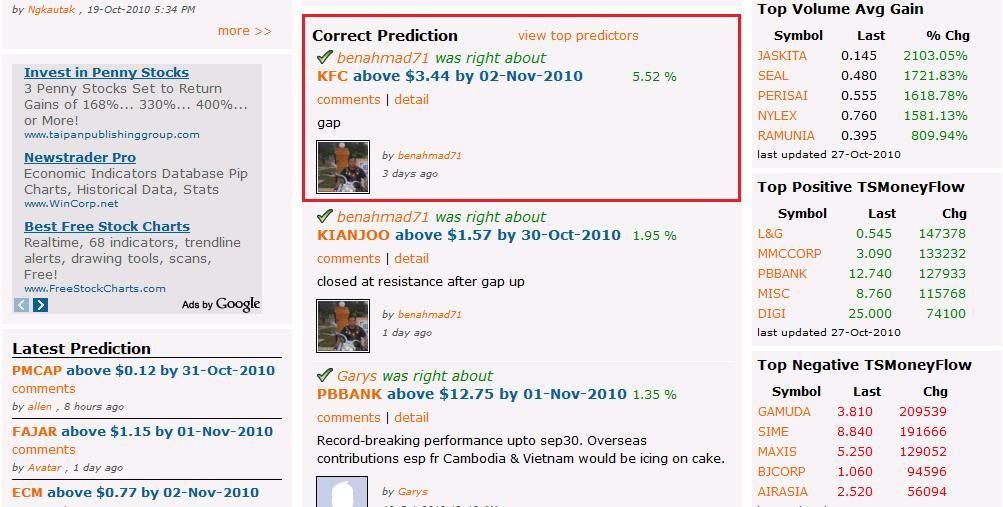

This week i'm very bz when oversea student visit Malaysia. But that couldn't stop me from carry on with my hobby, ie prediction. This monday, i like to watch AXIATA, IJMLAND, YTLE, GOODWAY and SUNRISE.

AXIATA

Acc/dist curving up, rsi "kiss of life", stochastic oversold, MACD green, volume above 30% increase and candlestick white hammer.

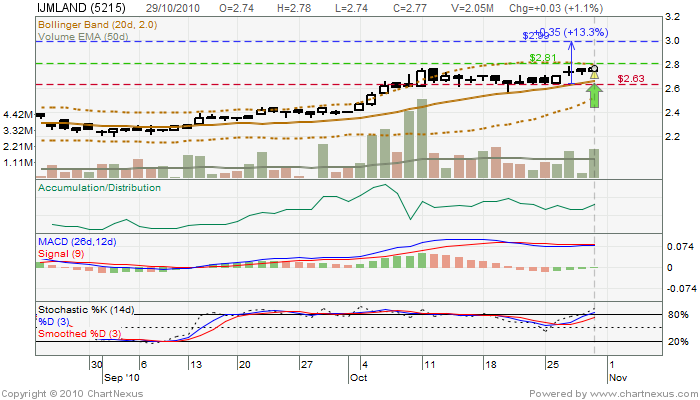

IJMLAND

Stochastic near 80%, acc/dist picking up, MACD green, volume high, candlestick bullish engulfing and waiting for the bollinger band break out.

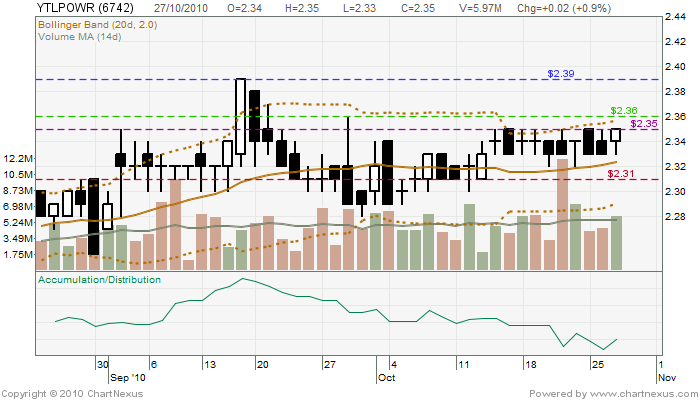

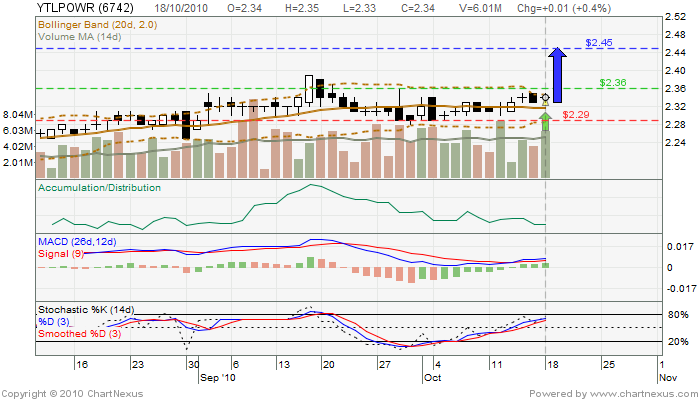

YTLE

YTLE show green MACD. White candlestick, volume increase 30%, stochastic & rsi ok. Look here. Wait for it to clear 1.53, then up to u. If compare with last uptrend, it is a lot of money.

GOODWAY

I see this GOODWAY potentially moved when acc/dist surge high and last friday price closing at resistance. MACD green, rsi good and stochastic also good. Pls watch on monday.

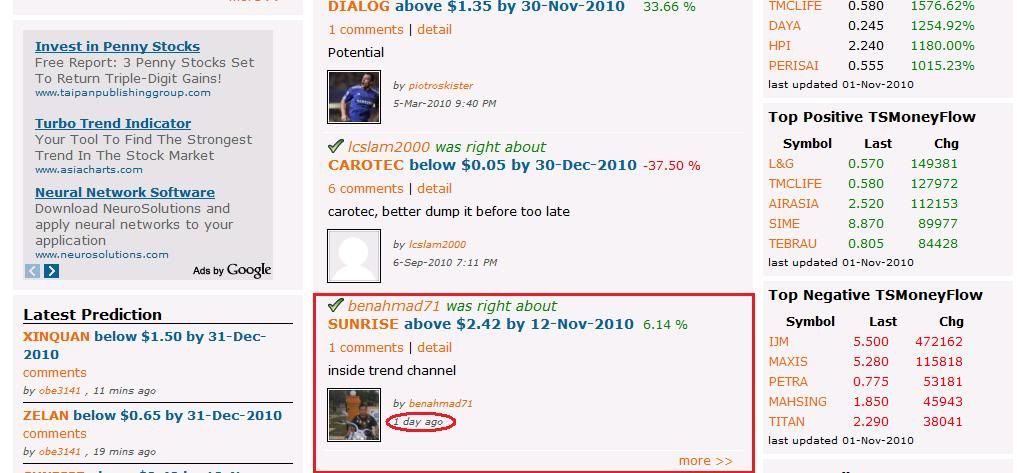

SUNRISE

There is 3 news today inside the Edge Malaysia which focus only on SUNRISE. With bollinger breakout stand at closing price on last friday, I could imagine that SUNRISE will easily take resistance at 2.42 this week.

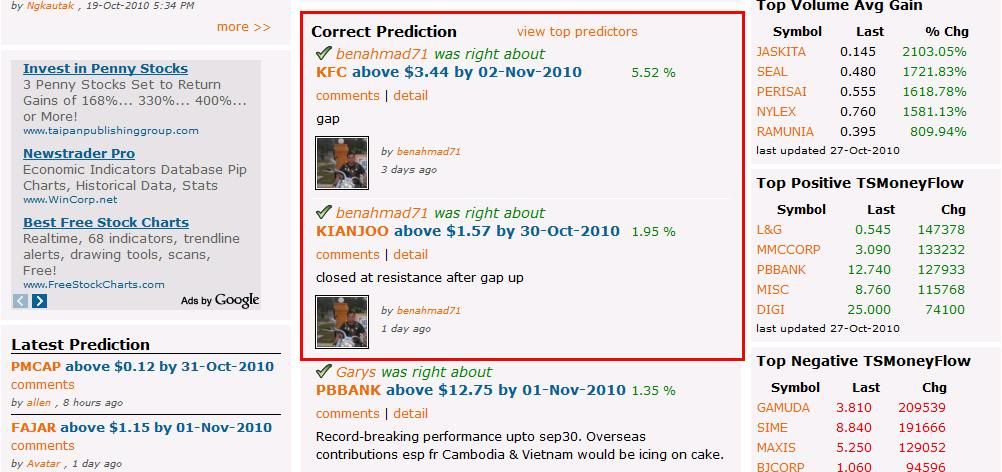

Today (1-11-2010) closed

Note: If u like my blog, i request u to sign in as a follower. Also u have to look at my last posting of OSK and ECM. TQ.